Construction sector borrows the most to fund insurance, analysis shows

Wholesale and Retail Trade is the fastest growing sector, Premium Credit Insurance Index shows.

More than half of SMEs use some form of credit to pay for insurance, borrowing an average of £1,080

July 3rd 2024 – New analysis (Premium Credit’s lending data for 2023, 2022 and 2021) from the UK’s leading insurance premium finance company, shows the Construction sector borrows the most to fund insurance but the Wholesale and Retail Trade sector is the fastest-growing.

The company's Insurance Index (Independent research conducted by Viewsbank online among 1,332 SME owners and managers between March 22nd and 26th 2024), monitors insurance buying and how it is financed,and shows 55% of SMEs now use some form of credit to pay for insurance borrowing an average of £1,080. Around 15% of them say they have borrowed more than £3,000.

Construction firms were the most likely to use credit – they accounted for 14.3% of all net advances from Premium Credit last year. That was 1.5% higher than in 2022 and 1.9% higher than 2021.

The Professional and Scientific sector accounted for the second highest share of net advances at 12.5% last year followed by Manufacturing on 10.4%, Wholesale and Retail Trade on 8.8% and Land Transport on 8.1%.

However it’s the Wholesale and Retail Trade sector which is recording the most growth – its share of net advances at 8.8% is 1.7% higher than in 2022 and 3.4% up on 2021.

Premium Credit’s Insurance Index shows around 50% of SMEs say the cost of their business insurance has increased in the past 12 months with 12% reporting dramatic increases. Around 17% of firms questioned say they have cut other costs in their business as a result of insurance premium increases in the past two years.

The table below shows the top five sectors for share of total lending to buy credit and how that has changed.

| TOP SECTORS | SHARE OF TOTAL LENDING | DIFFERENCE TO 2022 | DIFFERENCE TO 2021 |

| Construction | 14.3% | +1.5% | +1.9% |

| Professional & Scientific | 12.5% | +0.5% | +2.2% |

| Manufacturing | 10.4% | +0.8% | +0.9% |

| Wholesale & Retail Trade | 8.8% | +1.7% | +3.4% |

| Land Transport | 8.1% | +0.4% | -1% |

Jon Howells Chief Commercial Officer at Premium Credit commented: “Insurance is vital for business operations across a wide range of sectors as demonstrated by the strong growth in net advances we have seen year on year. It is particularly important in the construction sector which is consistently the biggest sector for lending.”

Premium finance companies like Premium Credit provide businesses and consumers with the ability to use a loan to pay for their insurance in monthly instalments. By managing insurance payments in this way, businesses and consumers can spread the cost of their insurance, rather than pay their premiums in one lump sum.

This article was issued via press release as 'construction sector borrows the most to fund insurance' dated July 3, 2024 by Premium Credit Limited.

[edit] Related articles on Designing Buildings

- Building Users' Insurance Against Latent Defects.

- Business interruption cover under COVID-19.

- Collateral warranties.

- Contractors' all-risk insurance.

- Contract works insurance.

- Counter Terrorism Security Advisor.

- Decennial liability.

- Design liability.

- Directors and officers insurance.

- Employer's liability insurance.

- Excepted risk.

- Fire safety exclusions - the insurance position.

- Flood insurance.

- Flood Re.

- Future of construction insurance.

- Indemnity to principals.

- Insurer of last resort.

- Insurance for building design and construction.

- Integrated project insurance.

- JCT Clause 6.5.1 Insurance.

- Joint names policy.

- Latent defects insurance.

- Legal indemnities.

- Legal indemnity insurance.

- Non-negligent liability insurance.

- Performance bond.

- Professional consultant's certificate.

- Professional Indemnity Insurance.

- Professional indemnity insurance in construction.

- Public liability insurance.

- Residual value insurance.

- Reverse premium.

- Self build insurance.

- Self insurance.

- Specified perils.

- Subcontractor default insurance (SDI).

- Warranty.

Featured articles and news

A case study and a warning to would-be developers

Creating four dwellings... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.

The first line of defence against rain, wind and snow.

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this...

National Apprenticeship Week 2026, 9-15 Feb

Shining a light on the positive impacts for businesses, their apprentices and the wider economy alike.

Applications and benefits of acoustic flooring

From commercial to retail.

From solid to sprung and ribbed to raised.

Strengthening industry collaboration in Hong Kong

Hong Kong Institute of Construction and The Chartered Institute of Building sign Memorandum of Understanding.

A detailed description from the experts at Cornish Lime.

IHBC planning for growth with corporate plan development

Grow with the Institute by volunteering and CP25 consultation.

Connecting ambition and action for designers and specifiers.

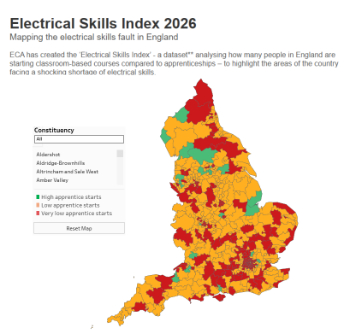

Electrical skills gap deepens as apprenticeship starts fall despite surging demand says ECA.

Built environment bodies deepen joint action on EDI

B.E.Inclusive initiative agree next phase of joint equity, diversity and inclusion (EDI) action plan.

Recognising culture as key to sustainable economic growth

Creative UK Provocation paper: Culture as Growth Infrastructure.